Under 45V rules, when is clean hydrogen cheaper than grey?

Core finding: Under finalized U.S. 45V rules, robust clean H2 parity versus grey mid/high in this analysis appears only within tight delivered-power and utilization windows: annual at or below $36/MWh with CF at or above 40%, hourly at or below $41/MWh with CF at or above 45%, and firmed hourly at or below $53/MWh with CF at or above 80%.

Why it matters: 45V turns hydrogen economics into a compliance-constrained threshold problem, not a nominal LCOH comparison. Matching, shaping, congestion, and losses can erase apparent low-price advantages.

Headline thresholds: Grey reference band in this note is $1.00 / $1.50 / $2.50 per kg (low/mid/high). Parity is broadly non-competitive at $70/MWh or higher (annual/hourly) or $85/MWh or higher (firmed), and when CF is 35% or lower (annual) or 40% or lower (hourly/firmed).

Method snapshot: Independent techno-economic parity modeling of delivered electricity translation, utilization sensitivity, loss/adders, and 45V credit-tier risk at the user gate.

Pull quote: "Under finalized 45V rules, clean hydrogen parity depends on delivered electricity and sustained utilization: robust parity in this analysis requires roughly $36 to $41 per MWh with 40% to 45% capacity factor for annual/hourly matching, while firmed hourly cases require roughly $53 per MWh and 80% utilization."

Under Treasury's finalized 45V hydrogen guidance, clean hydrogen is only cheaper than grey hydrogen under a narrow set of electricity price, matching, and utilization conditions. This analysis quantifies the exact thresholds by electricity cost, electrolyzer capacity factor, and procurement strategy at which clean hydrogen undercuts grey at the gate while remaining inside a qualifying credit tier.

Decision Summary

Decision question

Under finalized 45V rules, what electricity price, matching strategy, and utilization conditions allow clean hydrogen to undercut grey hydrogen at the gate while remaining credit-eligible?

Decision owner and deadline

- Decision owner: Founders / CTO (general, public-facing note)

- Decision deadline: Before procurement lock-in (PPA + matching strategy) or FEED commitment; irreversible or costly to reverse.

Applicability

This note applies the IQ Parity & Cliff Method to U.S. clean hydrogen under 45V. The method is domain-agnostic and can be adapted to SAF, ammonia, and e-fuels with pathway-specific benchmarks.

Confidence / robustness tag

Confidence: Medium. Benchmarks reflect 2024-2025 sources; policy rules valid as of February 1, 2026. Results are scenario-based, not predictions.

Decision context (fast read)

Treasury’s finalized 45V guidance turns green hydrogen parity into a compliance-constrained cost problem. The relevant decision is no longer whether green hydrogen can be cheap in theory, but when it can beat grey at the gate while preserving tier eligibility and utilization.

Key thresholds and feasibility bands

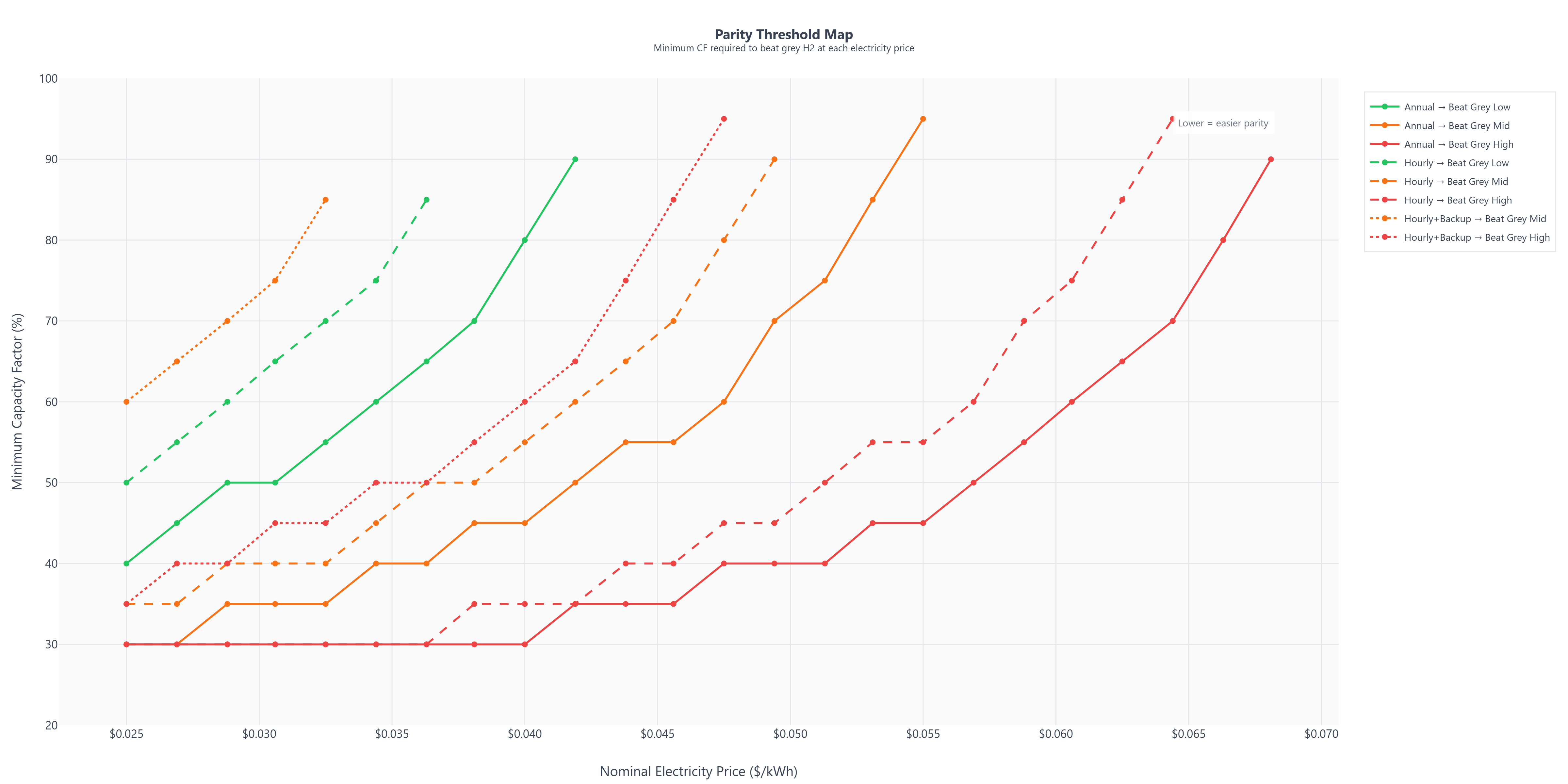

- Parity requires capacity factor at or above the strategy-specific thresholds shown in Figure 1 for the relevant electricity price band.

- Hourly matching (especially firmed) raises the required capacity factor and can push parity outside the feasible range at mid/high price bands.

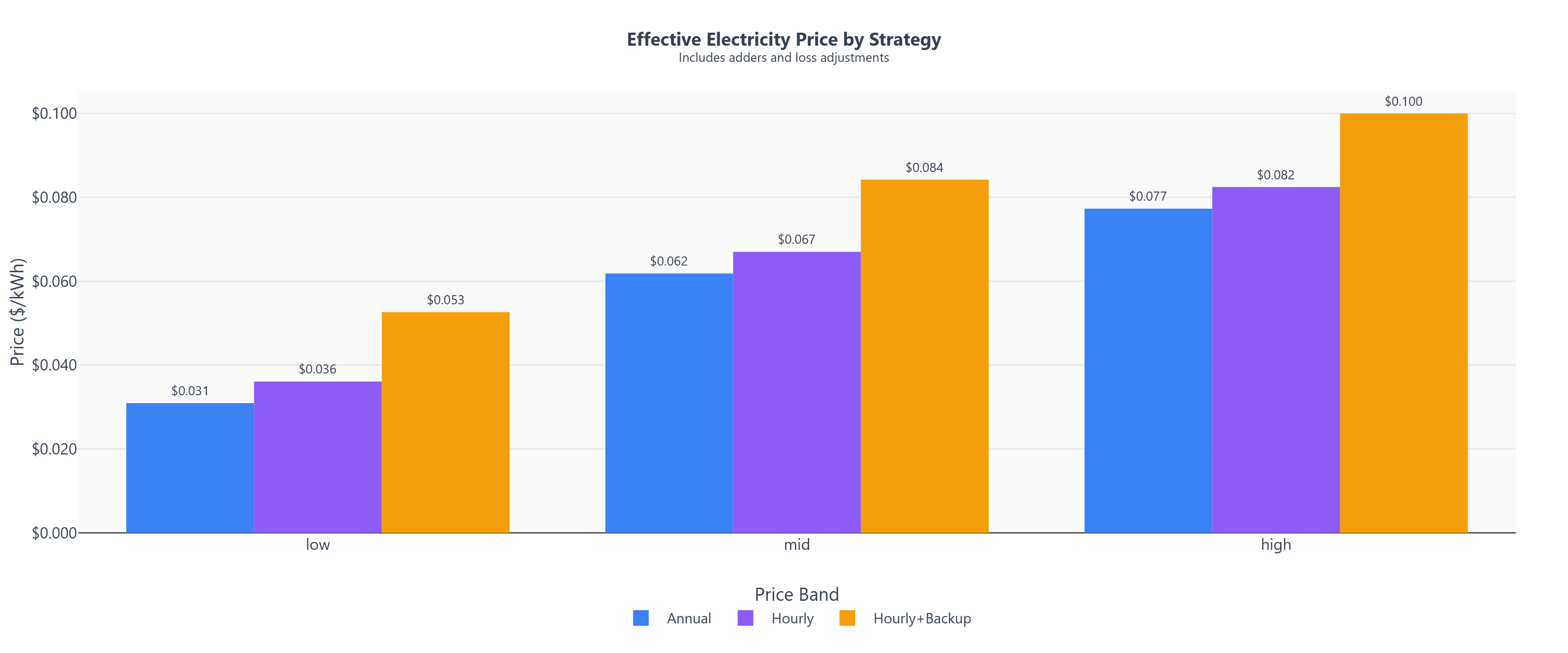

- Effective delivered electricity cost must fall within a narrow band once adders and losses are applied; nominal PPA price alone is not sufficient (Figure 3).

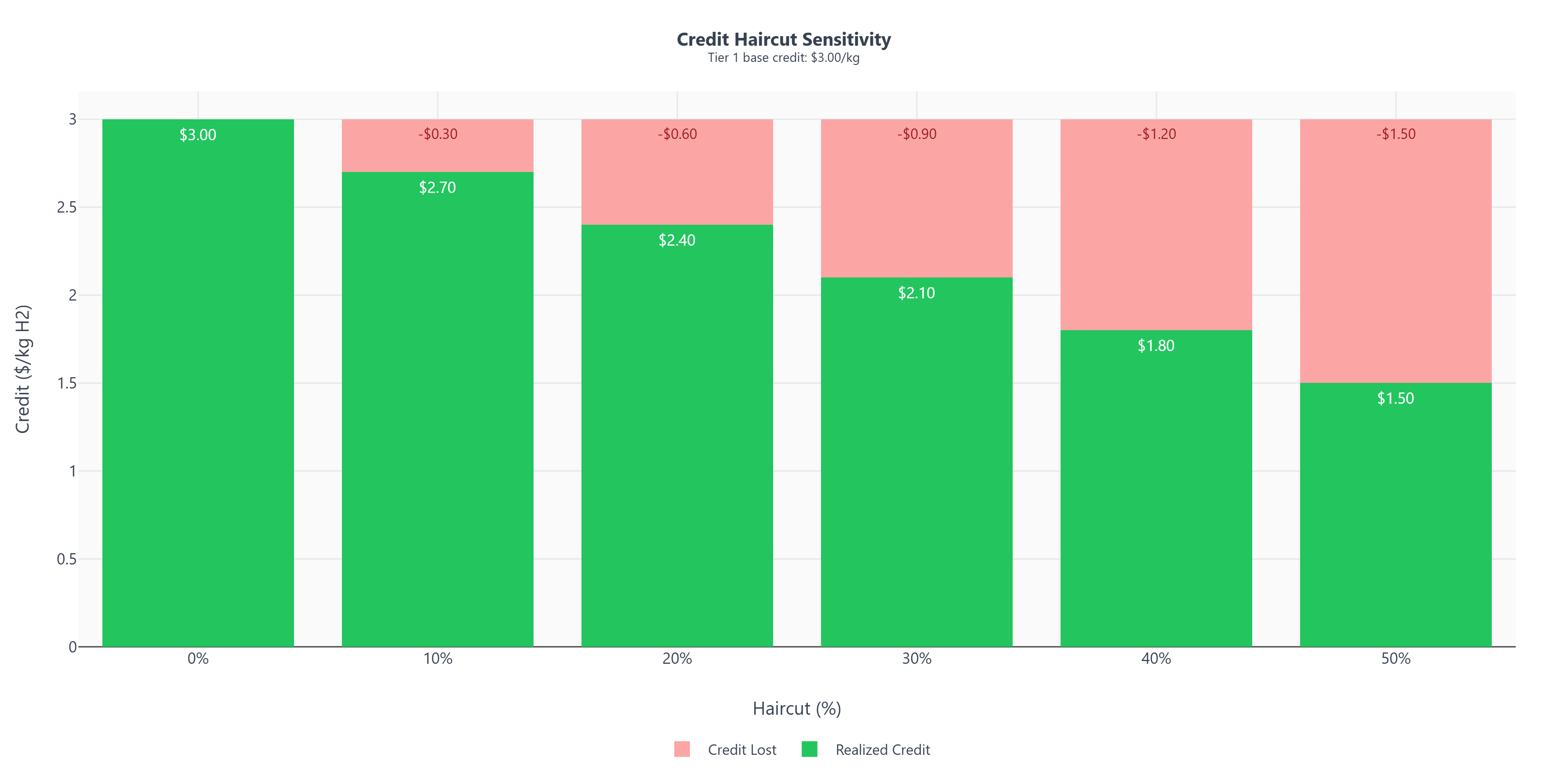

- Credit tier proximity introduces discontinuous downside; projects near tier boundaries experience effective credit haircuts that shift parity thresholds (Figure 2).

Dominant sensitivities (ranked)

- Electrolyzer utilization (capacity factor).

- Effective delivered electricity cost (matching adders + loss penalties).

- Realized 45V credit value (tier proximity and haircut risk). Secondary: electrolyzer efficiency/capex and financing assumptions (directional, not first-order).

Driver ranking method: Ranked by decision-flip frequency and parity-boundary area shift across the scenario grid.

Decision regimes

| Regime | Conditions (use Figure 1 and 3 thresholds) | Decision posture |

|---|---|---|

| Clearly viable | CF clears the relevant parity thresholds across the target price band and strategy; delivered electricity cost within the parity band; tier buffer maintained. | Proceed to site and contract diligence. |

| Conditional | Parity only at upper-end CF or only under annual matching assumptions; tier buffer thin. | Proceed only with stress tests and contract structure mitigation. |

| Non-viable | No parity within CF range for the target strategy/price band or parity only under unrealistic assumptions. | Do not proceed without structural changes. |

Representative archetypes (illustrative)

The thresholds below are presented as general decision boundaries. The archetypes here are reference configurations, not project claims, to help readers map the analysis to common development contexts.

- Co-located renewables, annual matching (Sun Belt-style): Lower nominal price, but utilization risk dominates. Use Figure 1 and 3 to test whether credible CF clears the annual-matched band after adders.

- Grid-connected, hourly matched (industrial hub): Higher delivered power costs with tighter compliance. Focus on the hourly-matched threshold curve and tier buffer sensitivity.

- Firmed hourly with storage/backup (merchant or load-following): Highest delivered power cost and loss penalties. Use the threshold map to verify parity remains inside feasible CF ranges.

Threshold Rules (derived from scenario grid)

Robust parity (holds across scenario ensemble within modeled bounds; grey mid/high reference cases)

- Annual matched: If delivered power <= $36/MWh and CF >= 40%, clean H2 undercuts grey mid/high across both electrolyzer types. At delivered <= $31/MWh, CF >= 35% clears grey mid/high with margin.

- Hourly matched: If delivered power <= $41/MWh and CF >= 45%, parity holds vs grey mid/high across both types. At delivered <= $36/MWh, CF >= 40% clears grey mid/high.

- Hourly + backup: If delivered power <= $53/MWh and CF >= 80%, parity holds vs grey mid/high. Below 80% CF, it only beats grey high.

Conditional parity (base-case only; sensitive to utilization and credit haircut assumptions)

- Annual matched: Around $46/MWh, parity vs grey mid requires CF >= 60%. Around $57/MWh, parity vs grey mid requires CF >= 85% and vs grey high requires CF >= 45%.

- Hourly matched: Around $52/MWh, parity vs grey mid requires CF >= 75%. Around $62-$67/MWh, parity is only vs grey high with CF >= 55-70%.

- Hourly + backup: Around $58/MWh, parity vs grey mid requires CF >= 95%. At $58-$68/MWh, parity is only vs grey high with CF >= 45-75%.

Non-competitive (holds across scenario ensemble within modeled bounds)

- If delivered power >= $70/MWh (annual/hourly) or >= $85/MWh (firmed), parity fails vs grey mid/high across the scenario grid.

- If CF <= 35% (annual) or <= 40% (hourly/firmed), parity vs grey mid is not achieved even at low delivered power.

Grey-low parity rules (base-case only; grey-low is a reference case, not a forecast)

- Annual matched: Delivered <= $31/MWh with CF >= 45% clears grey low; delivered <= $36/MWh requires CF >= 55%. Above ~$46/MWh, grey-low parity is only at extreme CF (~95%).

- Hourly matched: Delivered <= $36/MWh with CF >= 55% clears grey low; delivered <= $41/MWh requires CF >= 70%.

- Hourly + backup: No grey-low parity within the scenario grid (even at the lowest delivered price).

Risk rules (apply across scenario ensemble; re-test if tier proximity shifts)

- Tier boundary risk: If tier proximity implies >= 10% credit haircut (see Figure 2), treat parity as contingent and re-test thresholds with the haircuted credit.

- Utilization fragility: If parity clears only above the project’s credible CF band (e.g., >80%), treat it as structurally fragile.

Cliff mechanisms captured (policy valid as of February 1, 2026)

- 45V credit tier thresholds and verification rules (regulatory/eligibility thresholds)

- Matching/attribution requirements (annual, hourly, firmed)

- Delivered power adders and loss penalties

- Grey benchmark bands as reference cases

Assumes Tier 1 $3/kg credit with no haircut. Delivered power price includes modeled adders and loss penalties; rules require parity across both electrolyzer types and at least the grey mid/high benchmarks in the scenario grid (grey-low rules called out separately). Grey low/mid/high bands are reference cases, not forecasts; forward-looking inputs are scenario assumptions, not predictions; gas prices and supply chains vary materially by region and time.

Rapid circulation: Use the Decision Summary, Threshold Rules, and Decision Regimes for executive review. Internal diligence: Pair with Appendix A parameters. The full analytical record underlying this note, including scenario grids and sensitivity tables, is available upon request.

1) Fix the procurement profile: Map the project to an annual, hourly, or firmed strategy (or a hybrid) based on actual contract structure.

2) Translate to delivered power: Convert nominal PPA prices to effective delivered cost by applying shaping, congestion, REC/EAC, and loss assumptions.

3) Set a credible CF band: Use engineering and interconnection constraints to define a realistic utilization range.

4) Apply tier risk: Re-test parity with haircut scenarios if lifecycle emissions sit near tier boundaries.

5) Stress test grey benchmarks: Re-run thresholds using regional grey price ranges to bound downside risk.

1. Decision Context

Treasury’s finalized 45V guidance transforms clean hydrogen economics from a nominal LCOH comparison into a compliance-constrained cost problem. For developers and industrial users, the relevant question is no longer whether green hydrogen can be cheap in theory, but under what electricity price, matching strategy, and utilization conditions it can undercut grey hydrogen at the user gate while remaining inside a credit tier.

This creates a concrete siting and contracting decision: Do we prioritize cheap electrons with harder delivery and utilization risk, or easier delivery with higher power costs -and which procurement structures keep realized hydrogen cost below grey without falling out of the credit tier.

2. Dominant Drivers

Driver 1 - Effective Power Cost Under Matching Constraints

Engine results show that effective power cost -not headline PPA price -dominates clean H2 parity outcomes. Once hourly (or near-hourly) matching, congestion exposure, shaping, and curtailment effects are included, delivered electricity cost can diverge substantially from nominal prices.

Across representative scenarios, parity is achieved only when effective electricity cost falls below a narrow band; nominal low prices alone are insufficient if matching erodes utilization or introduces shaping penalties.

Driver 2 - Electrolyzer Utilization (Capacity Factor)

Utilization emerges as a first-order driver of LCOH, often outweighing nameplate CAPEX differences across electrolyzer configurations.

Model sweeps indicate that modest reductions in capacity factor can overwhelm gains from lower electricity prices, pushing clean hydrogen back above grey even when credit eligibility is preserved. This makes siting and procurement inseparable from utilization strategy.

Driver 3 - Credit Tier Proximity Risk

45V credits behave discontinuously. Being near a tier boundary introduces realized value risk that meaningfully affects parity.

Engine scenarios show that projects operating close to eligibility thresholds experience effective credit values significantly below the nominal tier, shifting parity conditions by meaningful margins. This creates a hidden tradeoff between aggressive cost minimization and credit robustness.

Sensitivity priority recap (for quick scan): 1) Capacity factor, 2) Delivered electricity cost, 3) Realized 45V credit value (tier haircut risk).

3. Results as Decision Thresholds

The figures below are presented as decision thresholds and feasibility bands. Each figure is paired with the decision it informs.

Visuals included (checklist)

- Parity threshold map (Figure 1)

- Cliff overlay (credit-tier haircut) (Figure 2)

- Effective electricity price breakdown (Figure 3)

- LCOH vs capacity factor curve (Figure 4)

- Decision regime table (Decision Summary)

Figure 1 - Parity Threshold Map

Minimum CF required to beat grey H2 at each electricity price

Figure 1: Minimum capacity factor required to achieve cost parity with grey hydrogen across electricity prices and matching strategies. Lower curves indicate easier parity conditions.

Across all matching strategies, the minimum capacity factor required for clean hydrogen to undercut grey increases sharply with electricity price, indicating that utilization -not nameplate cost -is the dominant parity lever. Hourly matching strategies consistently require higher utilization to reach parity.

Decision relevance: Use this map to identify the minimum CF required at each price band for the chosen matching strategy.

Figure 2 - Credit Haircut Sensitivity

Tier 1 base credit: $3.00/kg

Figure 2: Effective credit value under illustrative tier proximity scenarios. Green shows realized credit; red shows credit lost to boundary risk.

Projects operating near tier boundaries can experience effective credit values significantly below the nominal $3/kg, shifting parity conditions by meaningful margins even without changes in physical system performance.

Note: Illustrative haircut applied to represent verification and boundary risk under Treasury’s finalized emissions accounting framework.

Decision relevance: Treat tier proximity as a risk haircut; do not underwrite parity on nominal credit alone.

Figure 3 - Effective Electricity Price by Strategy

Includes adders and loss adjustments

Figure 3: Delivered electricity cost after matching requirements, firming costs, and transmission losses. Bars show three nominal price bands (low/mid/high) across three procurement strategies.

Across all price bands, effective electricity cost diverges substantially from nominal prices once matching and firming are included. This invalidates the assumption that "we locked in $0.03/kWh power" translates to "$0.03/kWh delivered to electrolyzer."

Note: Effective price reflects nominal price plus modeled adders (procurement/shaping) and loss penalties (transmission/conversion). See Appendix A for parameter values.

Decision relevance: Compare delivered cost, not PPA headline; adders and losses often dominate feasibility.

Figure 4 - LCOH vs Capacity Factor

Nominal electricity: $0.055/kWh | Credit: $3.00/kg (Tier 1)

Figure 4: Levelized cost of hydrogen as a function of electrolyzer capacity factor. Solid lines show net LCOH (post-credit); dashed lines show gross LCOH (pre-credit). Horizontal dashed lines indicate grey hydrogen cost benchmarks.

Across all matching strategies, LCOH declines nonlinearly with capacity factor, with modest reductions in utilization producing outsized cost increases. A project at 50% CF pays a steep LCOH penalty that cannot be recovered by marginal electricity cost reductions.

Decision relevance: Use this to judge how far utilization can fall before parity breaks under each strategy.

4. Decision Implications

Siting: Locations with ultra-low nominal electricity prices do not automatically win if delivery, congestion, or matching reduce utilization.

Procurement: Contracting structures that stabilize utilization and emissions alignment can be economically superior to lowest-price energy strategies.

Design: Electrolyzer sizing and operating philosophy should be co-optimized with matching strategy -not treated as fixed inputs.

Risk posture: Projects optimized to just clear a 45V tier may underperform those designed with margin, even at slightly higher baseline costs.

5. Scope & Boundaries

Boundary statements (scope gate):

- Geography/market: United States; 45V-eligible clean hydrogen markets.

- System boundary: Delivered-to-gate cost parity (user gate), not plant fence or policy-adjusted averages.

- Time boundary: Commercial year 2026 with 45V policy vintage valid as of February 1, 2026.

- Analytical scope (excluded disciplines): No legal interpretation, certification advice, detailed process engineering/design, permitting, or grid-dispatch modeling.

- Baseline definition: Grey hydrogen comparators defined by low/mid/high delivered cost benchmarks in Appendix A (reference cases only).

Interpretation guardrails: Forward-looking inputs are scenario assumptions, not predictions. This brief is an economic parity analysis; it is not legal advice, not a project certification, and not a forward price forecast.

6. Limitations & Critiques

- Scope excludes broader policy dynamics. The note does not address the underlying policy mechanics (e.g., hourly clean energy credit matching, additionality, deliverability rules, or timeline constraints) that are central to 45V compliance complexity. These rules materially influence cost outcomes and procurement feasibility. See: Treasury final rules, IRS IRB 2025-13.

- Limited context on market/attribute risk. While the note models matching strategies, it does not dig into real electricity market risks - grid congestion, capacity deliverability shortfalls, REC/EAC availability, or regional price volatility - that can drive delivered power costs far from model assumptions. See: RMI analysis.

- Benchmarking vs project-specific realities. Using stylized grey hydrogen cost bands and fixed electricity price ranges is a reference-case baseline and does not capture regional or temporal natural gas volatility, grid decarbonization dynamics, or supply configuration shifts. Forward-looking inputs are scenario assumptions, not predictions. Multiple benchmarks and sensitivities mitigate (but do not eliminate) this risk.

- No lifecycle emissions context. The analysis is strictly economic and does not integrate lifecycle GHG impacts beyond what is implied by 45V credit tiers. Broader environmental or carbon-pricing considerations are outside scope.

Response / Mitigations. This analysis is intentionally a parity lens. In practice, we recommend stress-testing parity against alternative matching regimes (annual vs hourly), regional deliverability constraints, and EAC price scenarios, and reporting those sensitivities alongside base-case parity maps. We also recommend pairing parity results with LCA summaries and policy-compliance checklists for project-specific diligence.

7. Methods & Traceability (Analytical Lens)

This note applies a techno-economic parity lens using representative model runs from the Insight Quantix analysis engine. Key features of the lens:

- Comparison at the user gate (not plant fence, not policy-adjusted averages)

- Explicit modeling of:

- Electricity procurement and matching structure

- Electrolyzer utilization impacts on LCOH

- Realized 45V credit value under tier proximity

- Grey hydrogen modeled as a delivered cost benchmark, not a theoretical SMR minimum

- Scenario vs sensitivity treatment: Matching strategy, electrolyzer type, and grey benchmark are discrete scenarios; electricity price and capacity factor are sensitivities within each scenario.

Results reflect parametric sweeps across the stated ranges (1,500+ scenario combinations covering 6 electricity price points x 14 capacity factor values x 3 matching strategies x 2 electrolyzer types x 3 grey benchmarks), filtered to illustrate dominance patterns and parity threshold behaviors. Results are illustrative of economic boundaries, not exhaustive optimization.

8. Appendix A: Modeling Parameters

Matching Strategy Configurations

| Strategy | Adders ($/kWh) | Loss Fraction | Basis |

|---|---|---|---|

| Annual matched, non-firmed | $0.005 | 3% | PPA shaping + scheduling costs |

| Hourly matched, non-firmed | $0.010 | 3% | Intra-hour balancing + congestion exposure |

| Hourly matched, firmed w/ backup | $0.025 | 5% | Battery/grid firming + round-trip losses |

Adders reflect incremental procurement costs beyond nominal PPA price. Loss fractions represent transmission, conversion, and utilization inefficiencies.

Scenario vs Sensitivity Classification

| Input group | Treatment | Notes |

|---|---|---|

| Matching strategy | Scenario | Discrete procurement regimes (annual/hourly/firmed) |

| Electrolyzer type | Scenario | PEM vs alkaline |

| Grey benchmark band | Scenario (reference case) | Low/mid/high delivered cost cases |

| Electricity price | Sensitivity | Continuous sweep within each scenario |

| Capacity factor | Sensitivity | Continuous sweep within each scenario |

Grey Hydrogen Benchmarks (delivered cost)

| Benchmark | Cost ($/kg H2) | Description |

|---|---|---|

| Low | $1.00 | Low-cost SMR with $3.00/MMBtu natural gas, no carbon capture (U.S. Gulf Coast baseline) |

| Mid | $1.50 | U.S. industrial average delivered cost, 2024-2025 (DOE Hydrogen Program Record 21006) |

| High | $2.50 | Merchant delivered, non-captive, or high-natural-gas-price regions |

Sources: DOE Hydrogen Program Records, IEA Global Hydrogen Review 2024, proprietary market analysis. Natural gas pricing as of Q4 2025. Grey benchmarks are reference cases, not forecasts; treated as scenario variants.

Analysis Engine Configuration

| Parameter | Value |

|---|---|

| Base Credit (Tier 1) | $3.00/kg H2 (45V maximum for <0.45 kg CO₂e/kg H2) |

| Electricity price range | $0.025-$0.070/kWh (nominal, pre-adders); grid points: $0.025, $0.03, $0.04, $0.05, $0.055, $0.07 |

| Capacity factor range | 30%-95% |

| Electrolyzer configurations | PEM (55 kWh/kg) and alkaline (50 kWh/kg) |

| Economic framework | ASTM E3200-compliant TEA with ISO 14040/14044 LCA integration |

| Discount rate | 8% real (project finance baseline) |

| Project lifetime | 20 years |

All analyses conform to benchmark-anchored validation protocols as described in Insight Quantix TEA-LCA Engine documentation. CAPEX and OPEX assumptions align with NREL 2024 electrolytic hydrogen cost models (adjusted for 2025 learning curves).

9. Citation Readiness & Reproducibility

-

Publication date & version: February 1, 2026 v1.3 - Canonical URL: https://insightquantix.com/insights/45v-hydrogen-cost-parity-electricity-price/

- Inputs table: Appendix A (benchmarks + author assumptions labeled; scenario vs sensitivity classified)

- Reproducibility note: Parity boundaries are most sensitive to delivered power adders, capacity factor assumptions, and credit tier eligibility; changes to these inputs will shift decision regions.

- Disclosure: Insight Quantix derived all analytical conclusions independently; references provide context only.

- Policy validity: 45V rule interpretation and cliff mapping valid as of February 1, 2026.

10. Next Steps

For Industry Readers

This analysis is intended to inform decision-making around:

-

Techno-economic risk drivers in policy-constrained clean energy systems

-

CAPEX and OPEX benchmarking relative to real-world deployment data

-

Sensitivity and stress-test scenarios that materially affect parity outcomes

-

Decision thresholds relevant to internal investment committee review

For correspondence regarding the analysis or its assumptions:

Contact: jamie@insightquantix.com

For Researchers and Collaborators

Full methodology documentation, sensitivity parameter sets, and benchmark validation protocols available upon request for academic collaboration or peer review.

Related Notes

This analysis is part of Insight Quantix’s analytical note series applying the IQ Parity & Cliff Method to clean energy decision problems.

Upcoming analyses:

- SAF Cost Parity — When does sustainable aviation fuel beat fossil jet under LCFS + SAF credit regimes?

- Green Ammonia Parity — Under what electrolyzer utilization and electricity price conditions does green NH₃ undercut SMR-based ammonia?

- e-Methanol Thresholds — Power-to-liquids production cost boundaries for e-methanol pathway viability.

Subscribe at insightquantix.com to receive new notes.

How to Cite This Analytical Note

APA Format

Gomez, J. (2026). Hydrogen: 45V cost parity vs grey -A techno-economic analysis of electricity procurement, electrolyzer utilization, and credit-tier risk under U.S. 45V rules (Insight Quantix Analytical Note IQ-AN-H2-45V-2026-01). Retrieved from https://insightquantix.com/insights/45v-hydrogen-cost-parity-electricity-price

Chicago Format

Gomez, Jamie. “Hydrogen: 45V Cost Parity vs Grey -A Techno-Economic Analysis of Electricity Procurement, Electrolyzer Utilization, and Credit-Tier Risk under U.S. 45V Rules.” Insight Quantix Analytical Note IQ-AN-H2-45V-2026-01, February 1, 2026. https://insightquantix.com/insights/45v-hydrogen-cost-parity-electricity-price.

BibTeX

@techreport{Gomez2026_H2_45V,

author = {Gomez, Jamie},

title = {Hydrogen: 45V Cost Parity vs Grey},

institution = {Insight Quantix},

year = {2026},

type = {Analytical Note},

number = {IQ-AN-H2-45V-2026-01},

month = feb,

url = {https://insightquantix.com/insights/45v-hydrogen-cost-parity-electricity-price}

}

Changelog

- v1.3 (2026-02-01): Added scope gate, confidence tag, scenario/sensitivity classification, cliff validity, and citation readiness updates.

- v1.2 (2026-01-30): Expanded archetypes and site diligence guidance; updated author bio.

About the Author

About Insight Quantix

Insight Quantix publishes independent analytical work for transparency and decision clarity. The analysis examines benchmark-anchored, audit-defensible economic risk conditions relevant to capital allocation decisions in the $10M–$500M range

Validation Methodology: ASTM E3200 | ISO 14040/14044 | NREL benchmark-anchored Engine Documentation: Available upon request Website: insightquantix.com

Legal Disclaimer

This analytical note is provided for informational and educational purposes only and does not constitute investment advice, financial advice, engineering design recommendations, or legal interpretation of tax policy. Readers should conduct independent due diligence and consult qualified professionals before making capital allocation decisions.

The analysis reflects representative scenarios based on stated modeling parameters and should not be construed as a guarantee of project performance or economic outcomes. Specific project economics require site-specific analysis accounting for local conditions, technology configurations, and regulatory environments.

Insight Quantix makes no warranties, express or implied, regarding the accuracy, completeness, or reliability of this information for any particular purpose.

© 2026 Insight Quantix. This analytical note may be cited with proper attribution.