Under 45V, when does cheap electricity still produce expensive hydrogen?

Core finding: Under finalized 45V rules, clean hydrogen fails to beat grey when electrolyzer utilization falls below approximately 50 percent capacity factor, even at delivered electricity prices below approximately $40 per MWh. Utilization, not electricity price, is the gating variable for cost parity.

Why it matters: The clean hydrogen investment thesis is often reduced to finding cheap power. This framing obscures a more fundamental constraint. Electrolyzers must operate at sufficiently high and stable utilization to amortize capital and realize credit value. Procurement strategies optimized for low nominal electricity prices frequently introduce intermittency or matching constraints that collapse realized utilization, erasing apparent cost advantages and breaking parity with grey hydrogen.

Headline thresholds: Grey reference band is $1.00, $1.50, and $2.50 per kilogram for low, mid, and high cases. Parity is non-competitive when capacity factor falls below approximately 50 percent, regardless of electricity price. A cheap power trap emerges below approximately 60 percent capacity factor, where capital recovery dominates and further electricity price reductions do not restore parity.

Method snapshot: Independent techno-economic parity modeling of electrolyzer utilization, delivered electricity price including losses and adders, and 45V credit interactions at the user gate.

Pull quote: "Under 45V, cheap electricity does not guarantee cheap hydrogen. Below approximately 50 percent capacity factor, clean hydrogen fails to beat grey even at delivered prices below approximately $40 per MWh."

Under finalized 45V rules, low-cost electricity fails to deliver clean hydrogen parity when electrolyzer utilization falls below critical thresholds, even at delivered prices that appear competitive on paper. This analysis quantifies where utilization constraints break parity and identifies the procurement regimes most exposed to this risk.

Decision Summary

Decision question

Under finalized 45V rules, at what electrolyzer utilization levels does low-cost electricity fail to deliver clean hydrogen cost parity with grey due to eligibility-constrained economics?

Decision owner and deadline

- Decision owner: Founder / CTO / VP Engineering

- Decision deadline: Prior to site selection, electrolyzer sizing, and electricity procurement contracting. Once these decisions are locked, utilization outcomes and credit eligibility become costly or impossible to reverse.

Applicability

This analysis applies to U.S. clean hydrogen projects seeking 45V credits under finalized Treasury guidance. The analytical method is domain-agnostic and transferable to other policy-constrained energy systems where utilization and eligibility interact, including clean ammonia and power-to-liquids fuels.

Confidence / robustness tag

Confidence: Medium–High. Benchmarks reflect recent U.S. grey hydrogen cost ranges and commercial electrolyzer performance. Policy rules reflect Treasury guidance valid as of February 2026. Results are scenario-based and illustrate decision thresholds, not forecasts.

Decision context (fast read)

Under 45V, clean hydrogen economics are jointly constrained by electricity price, electrolyzer utilization, and credit eligibility. While low-cost electricity is often treated as the dominant lever, utilization losses arising from intermittent supply, matching constraints, or procurement strategy can erase apparent cost advantages. The relevant decision is not whether cheap power exists, but whether it can be converted into sufficiently high and stable electrolyzer utilization to sustain parity with grey hydrogen at the user gate while remaining inside a viable credit tier.

Key thresholds and feasibility bands

- Utilization viability threshold: Below approximately 50 percent electrolyzer capacity factor, low cost electricity fails to offset fixed capital recovery and credit dilution, breaking parity with grey hydrogen despite favorable nominal electricity prices.

- Parity feasibility band: Clean hydrogen parity is achievable only within a bounded region defined jointly by delivered electricity price below approximately $40 per MWh and sustained utilization above approximately 50 percent. Falling outside either boundary shifts the project into a conditional or non-viable regime.

- Cheap-power trap: Electricity prices that appear competitive at low utilization can result in higher delivered hydrogen cost than higher priced but more reliable power that sustains higher utilization. Below approximately 60 percent capacity factor, capital recovery dominates and further electricity price reductions no longer restore parity.

- Policy-amplified cliff: Utilization shortfalls near eligibility or credit tier boundaries amplify cost penalties, creating sharp discontinuities in realized hydrogen cost rather than smooth sensitivity behavior.

Dominant sensitivities (ranked)

- Electrolyzer capacity factor (utilization)

- Delivered electricity price (including losses and adders)

- Capital recovery burden under reduced operating hours

Secondary: Electrolyzer efficiency, minor transmission losses, non-power OPEX.

Driver ranking method: Ranked by decision-flip frequency and parity-boundary area shift across the scenario grid.

Decision regimes

(Annual matched, grey mid - see Executive Intelligence for general thresholds)

| Regime | Conditions | Decision posture |

|---|---|---|

| Clearly viable | Delivered ≤ $36/MWh with CF ≥ 40%, or ≤ $31/MWh with CF ≥ 35%. | Proceed with site-level diligence and contract optimization. |

| Conditional | Around $46/MWh requires CF ≥ 60%; around $57/MWh requires CF ≥ 85% (grey mid). | Re-scope procurement strategy or reassess electrolyzer sizing. |

| Non-viable | Delivered ≥ $70/MWh or CF ≤ 35%. | Do not proceed under current configuration. |

Representative archetypes (illustrative)

The thresholds below are presented as general decision boundaries. The archetypes here are reference configurations, not project claims, to help readers map the analysis to common development contexts.

- Low-cost, intermittent power with low sustained utilization: Appears cost-competitive on nominal $/MWh but fails parity due to utilization collapse. Use threshold map to verify CF remains above viability floor.

- Moderate-cost, firm power with high utilization: Higher nominal electricity price offset by sustained capacity factor. Often clears parity where intermittent strategies fail.

- Hybrid procurement with partial firming and intermediate utilization: Mixed strategy that can recover parity if utilization remains stable across matching periods.

Decision Rules (Annual Matched, Grey Mid)

Clearly viable

- Delivered ≤ $36/MWh with CF ≥ 40%.

- Delivered ≤ $31/MWh with CF ≥ 35%.

Conditional

- Around $46/MWh requires CF ≥ 60%.

- Around $57/MWh requires CF ≥ 85% (grey mid).

Non-viable

- Delivered ≥ $70/MWh or CF ≤ 35%.

Risk rules (apply across scenario ensemble)

- Treat utilization as a gating variable, not a sensitivity.

- Re-evaluate parity whenever procurement strategy, matching regime, or electrolyzer sizing materially changes.

Cliff mechanisms captured (policy valid as of February 2026)

- Matching-driven utilization collapse (hourly vs annual matching)

- Credit value dilution under boundary haircuts

- Fixed-cost amplification under reduced operating hours

- Grey benchmark bands as reference cases

Assumptions note: Forward-looking inputs are scenario assumptions, not predictions. Grey benchmark bands reflect recent U.S. market ranges; actual grey hydrogen costs vary by region and time.

Rapid screening: Use the Decision Summary and Decision Rules to determine whether a project's power procurement and utilization profile is structurally compatible with clean hydrogen parity under 45V. Internal diligence: Pair with Appendix A parameters and stress-test utilization assumptions before committing to detailed engineering or contracting.

1) Map candidate sites: Plot candidate sites onto the electricity price × utilization domain using realistic (not optimistic) CF estimates.

2) Identify decision regime: Determine whether the site falls into clearly viable, conditional, or non-viable territory.

3) Stress-test utilization: Apply curtailment, matching, and intermittency scenarios to test whether CF remains above viability threshold.

4) Apply credit haircuts: Re-evaluate parity under credit boundary haircuts if lifecycle emissions sit near tier thresholds.

5) Gate the decision: Proceed only if parity remains robust under stress scenarios; otherwise, re-scope procurement or abandon.

1. Decision Context

The economics of clean hydrogen under 45V are often summarized as a race to the lowest electricity price. This framing obscures a more fundamental constraint: electrolyzers must operate at sufficiently high and stable utilization to amortize capital costs and fully realize credit value.

Procurement strategies that prioritize low nominal electricity prices frequently introduce intermittency, curtailment, or matching constraints that suppress realized utilization. Under 45V, these utilization losses are amplified by eligibility and credit-tier rules, transforming what appears to be a continuous sensitivity into a discontinuous feasibility problem.

The failure chain is specific. Matching constraints reduce available operating hours. Reduced operating hours lower effective capacity factor. Lower capacity factor increases capital recovery per kilogram. Once capital recovery dominates the cost stack, electricity price savings no longer affect parity. The project fails not because power is expensive, but because the electrolyzer does not run enough to amortize itself.

Premise: Low electricity prices typically require intermittent renewable procurement or constrained matching windows.

Implication: Intermittency and matching constraints reduce realized electrolyzer operating hours, lowering effective capacity factor.

Outcome: Lower capacity factor increases levelized capital recovery per kilogram of hydrogen, overwhelming any electricity cost savings.

Conclusion: Price alone is insufficient. Without reliable utilization above the viability threshold, cheap power produces expensive hydrogen.

The relevant decision is not whether cheap power exists, but whether it can be converted into hydrogen production economics that beat grey at the user gate, while remaining inside a viable credit tier. This note quantifies where that conversion fails.

Where the companion parity analysis identifies the feasible regions for clean hydrogen cost competitiveness, this note examines why many projects fail to remain within them.

1.1 Policy Context (Why Matching Rules Matter)

45V eligibility hinges on three constraints that directly amplify utilization risk:

Additionality - Electricity must come from generation capacity that would not have been built absent the hydrogen project. This limits access to existing low-cost baseload and pushes projects toward new-build renewables with inherently variable output.

Deliverability - The clean electricity must be deliverable to the electrolyzer location within the same region or balancing authority. Congestion, transmission constraints, and locational pricing differences can force projects to curtail or accept higher-cost power to maintain compliance.

Temporal matching - Under hourly matching, the electrolyzer can only run when matched clean generation is producing. This directly constrains capacity factor for intermittent-coupled projects and introduces weather-driven utilization volatility that annual matching would otherwise smooth.

These three pillars interact to create a utilization penalty that is not visible in nominal PPA pricing. A project with access to low-cost wind at $25/MWh may realize only 35-45% CF under hourly matching, pushing effective hydrogen cost above grey parity despite the apparent electricity price advantage.

The 45V framework transforms cheap intermittent power from an advantage into a potential liability. Projects must evaluate not just electricity price, but the utilization regime implied by their compliance pathway.

2. Dominant Drivers

Driver 1 - Electrolyzer Utilization (Capacity Factor)

Utilization governs fixed cost recovery and effective credit realization. Below a minimum capacity factor, even deeply discounted electricity cannot sustain parity with grey hydrogen.

Model results show that below approximately 50 percent CF, clean hydrogen LCOH exceeds grey benchmarks regardless of delivered electricity price within the modeled range. Utilization is the gating variable, not a secondary sensitivity.

Driver 2 - Electricity Procurement Strategy

Matching regime and firming choices determine realized utilization, not just nominal price. Annual matching preserves higher utilization than hourly matching for intermittent supply; firming adds cost but stabilizes CF.

Procurement strategies that reduce nominal electricity cost but simultaneously reduce utilization can result in net higher LCOH. The cheap power headline does not survive utilization-adjusted accounting.

Driver 3 - Capital Recovery Under Reduced Hours

Lower utilization increases per-kg capital burden, compounding electricity cost penalties. This effect is nonlinear: small utilization losses at low CF have outsized cost impacts.

At approximately 50 percent CF, capital contribution to LCOH is materially higher than at 60 percent CF. This differential can exceed the cost savings from further electricity price reductions.

Utilization vs. price elasticity

The cheap power trap is quantifiable. Across the modeled scenario grid, a one-percentage-point reduction in capacity factor increases LCOH by approximately $0.03-$0.06 per kilogram in the 40-60 percent CF range, while a one-dollar-per-MWh reduction in electricity price decreases LCOH by approximately $0.02-$0.03 per kilogram at the same utilization levels.

The ratio of these sensitivities defines the utilization-price trade-off: below approximately 60 percent CF, each percentage point of utilization lost costs more than each dollar per MWh saved. This asymmetry widens as CF falls further. At 40 percent CF, the utilization sensitivity is roughly two to three times the price sensitivity, meaning a procurement strategy that reduces electricity cost by $5/MWh but also reduces CF by 5 percentage points results in a net LCOH increase.

Below 60 percent CF, every percentage point of utilization is worth more than every dollar per MWh of electricity savings. When evaluating procurement trade-offs, weight utilization impact at least twice as heavily as price impact in the sub-60 percent CF range.

Sensitivity priority recap (for quick scan): 1) Electrolyzer utilization (capacity factor), 2) Delivered electricity price, 3) Capital recovery under reduced hours.

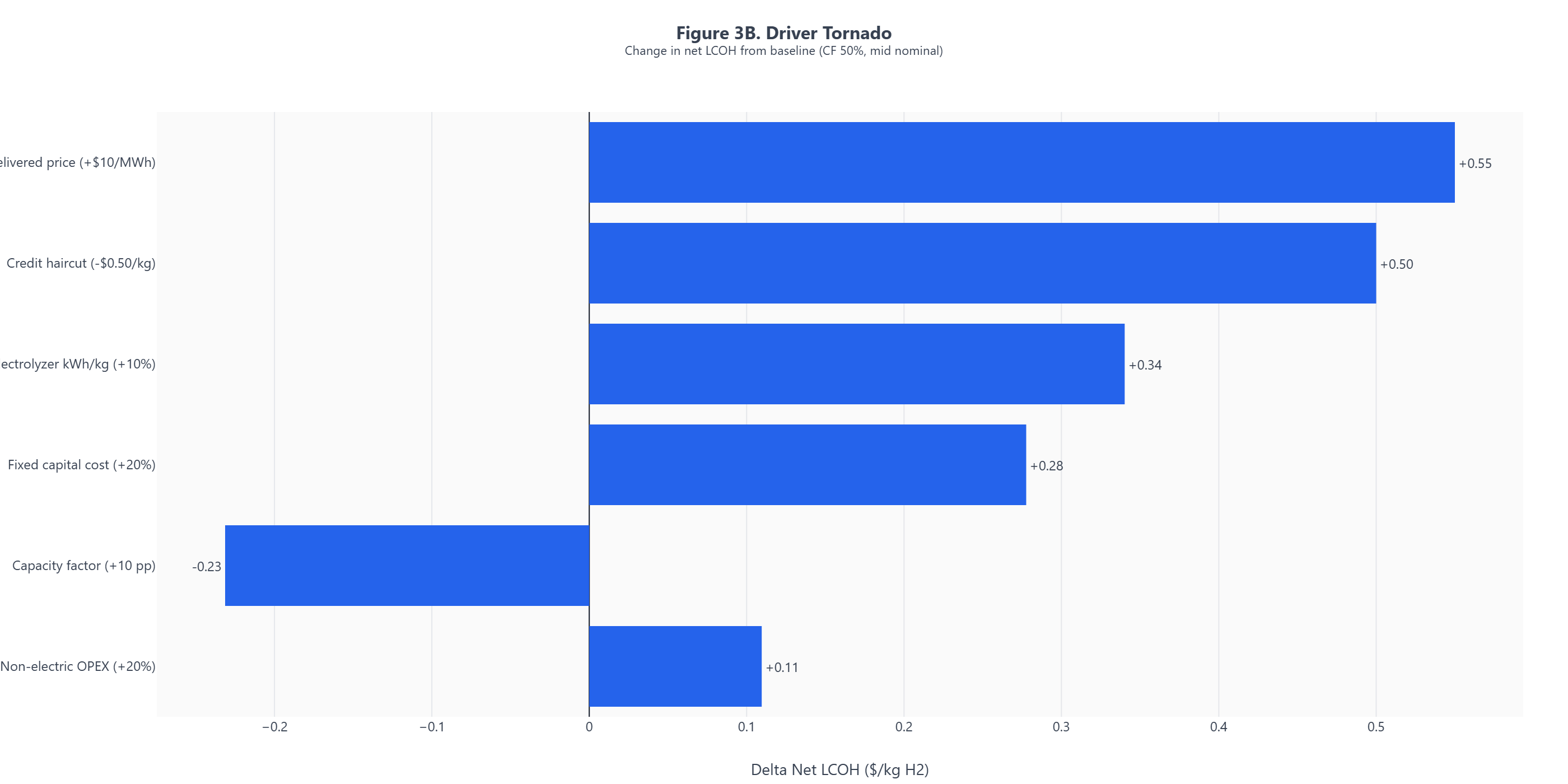

Figure 5 - Driver Sensitivity Tornado

LCOH impact per unit change in each input variable

Figure 5: Capacity factor dominates LCOH sensitivity by a factor of two to three relative to electricity price in the sub-60 percent CF range. Secondary drivers (electrolyzer efficiency, non-power OPEX) have marginal impact on the decision boundary.

Utilization is not first among equals. It is the dominant variable by a wide margin. The tornado chart confirms that capacity factor swings produce LCOH changes two to three times larger than equivalent electricity price swings. Secondary variables do not materially shift the parity boundary.

Decision relevance: Use the tornado ranking to prioritize diligence effort. Spend the most time validating utilization assumptions; spend less time refining secondary cost inputs that do not affect the viability decision.

3. Results as Decision Thresholds

The figures below are presented as decision thresholds and feasibility bands. Each figure is paired with the decision it informs.

Visuals included (checklist)

- Parity threshold map with decision contours (Figure 1)

- LCOH risk surface (Figure 1B)

- Utilization cliff overlay (Figure 2)

- Effective electricity price breakdown (Figure 3)

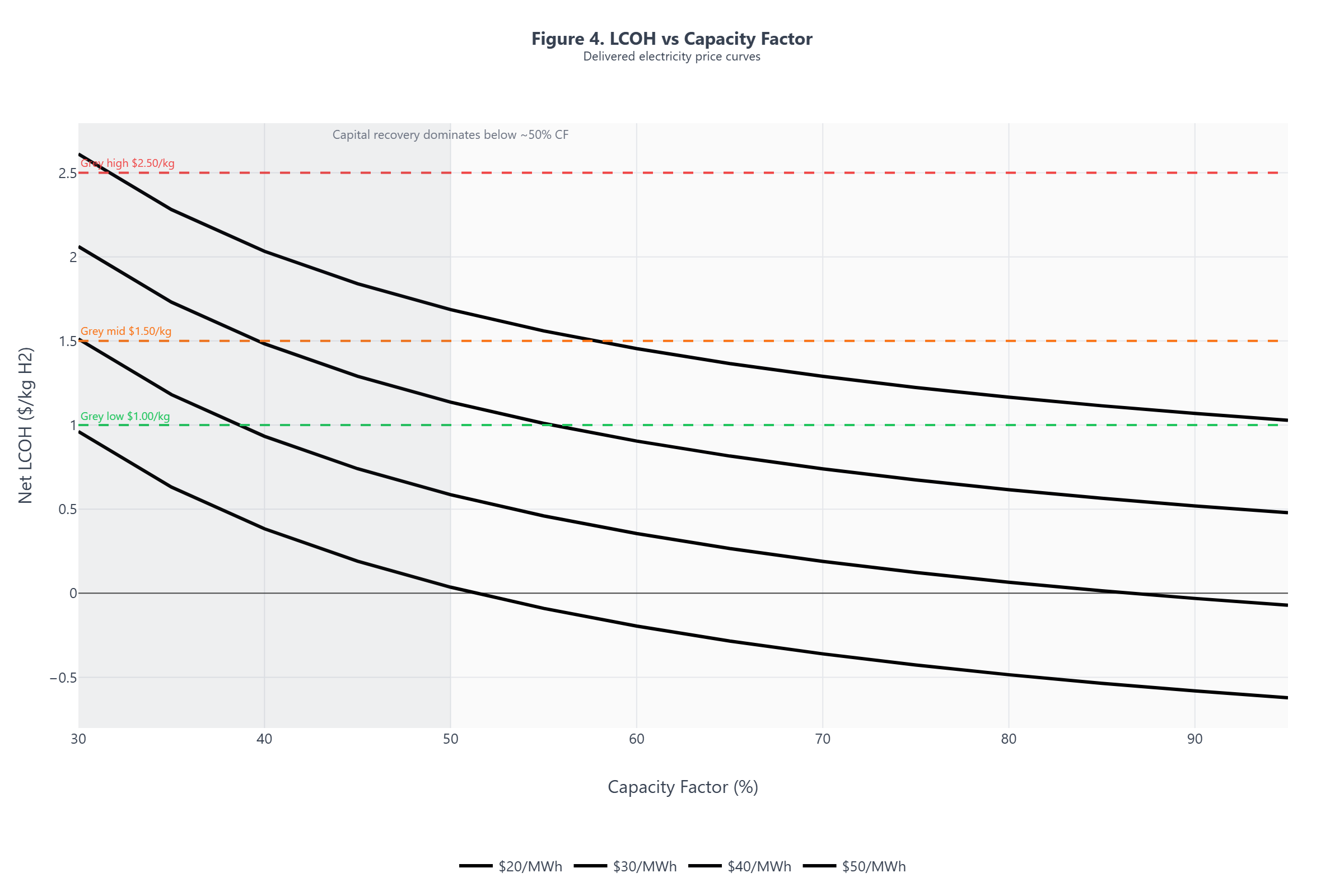

- LCOH vs capacity factor curve (Figure 4)

- Decision regime table (Decision Summary)

- Driver sensitivity tornado (Figure 5)

Figure 1 - Utilization-Price Parity Map with Decision Contours

Minimum CF required to beat grey H₂ at each electricity price, with iso-cost contours

Figure 1: Parity requires sustained capacity factor above approximately 50 percent. Decision contours show the minimum viable CF at each price band: at $30/MWh, parity requires approximately 45 percent CF; at $50/MWh, approximately 70 percent CF. The feasibility region narrows sharply above $40 per MWh.

The parity feasibility band is narrower than commonly assumed. Projects below the utilization floor (approximately 50 percent CF) cannot achieve parity regardless of electricity price. The decision contours make the trade-off explicit: every $10/MWh increase in delivered electricity price requires roughly 10-15 additional percentage points of CF to maintain parity.

Decision relevance: Use the contour lines to screen whether a site's realistic utilization clears the minimum threshold for its expected electricity price band. Plot candidate sites directly onto this map during early-stage screening.

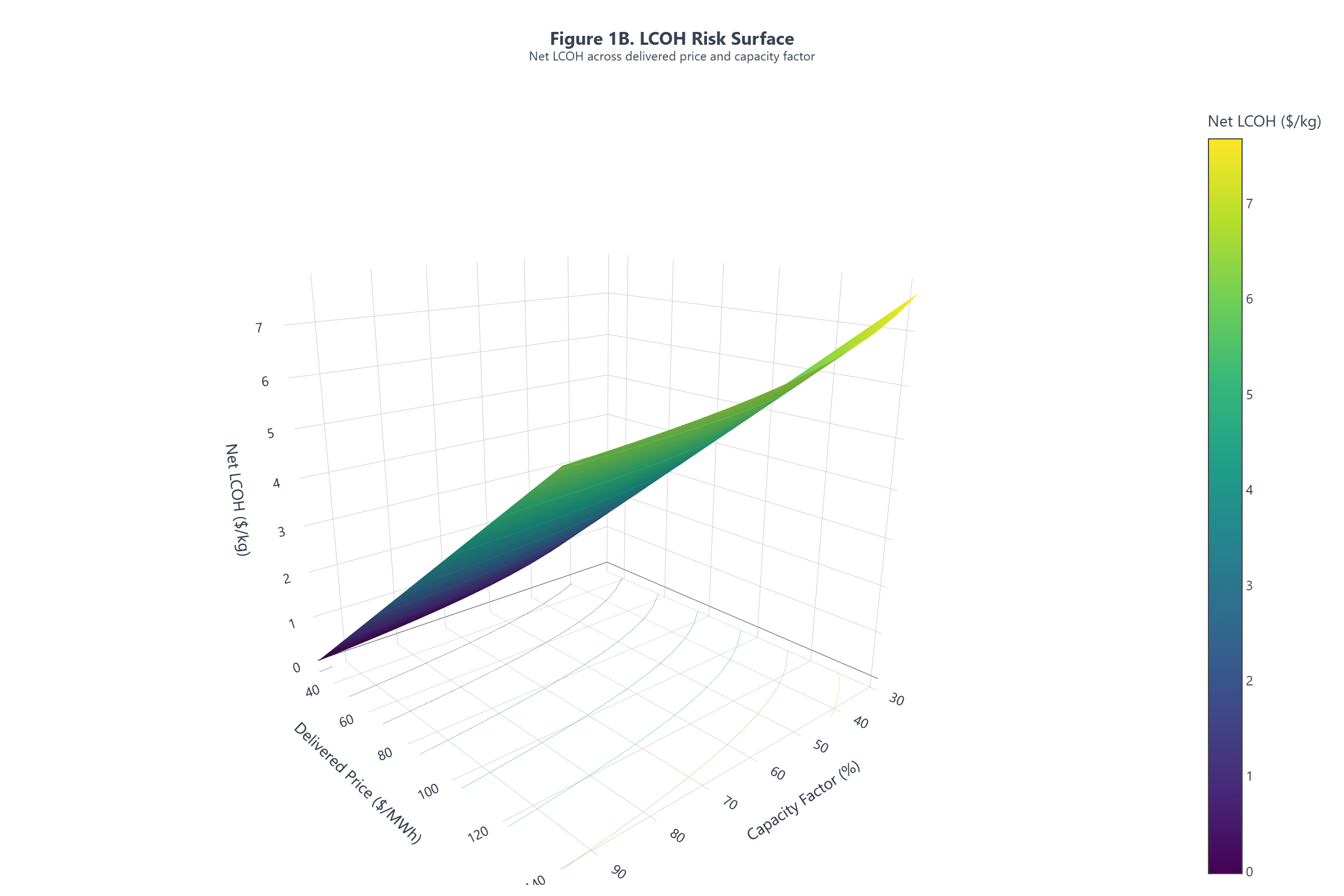

Figure 1B - LCOH Risk Surface

Delivered hydrogen cost as a function of electricity price and capacity factor

Figure 1B: The LCOH surface reveals the full cost landscape across the price-utilization domain. The steep wall below 50-60 percent CF confirms that cost behavior is cliff-like, not gradual. The flat region above 70 percent CF and below $40/MWh defines the structurally viable zone.

The surface makes visible what the threshold map implies: there is no smooth path from low utilization to parity. The cost landscape has a wall, not a slope. Projects on the wrong side of the wall cannot cost-optimize their way to viability through electricity price reductions alone.

Decision relevance: Use the surface plot to visualize the magnitude of cost penalties at different operating points. The vertical axis quantifies what the parity map shows as boundaries: how much cost increases when a project drifts outside the feasibility region.

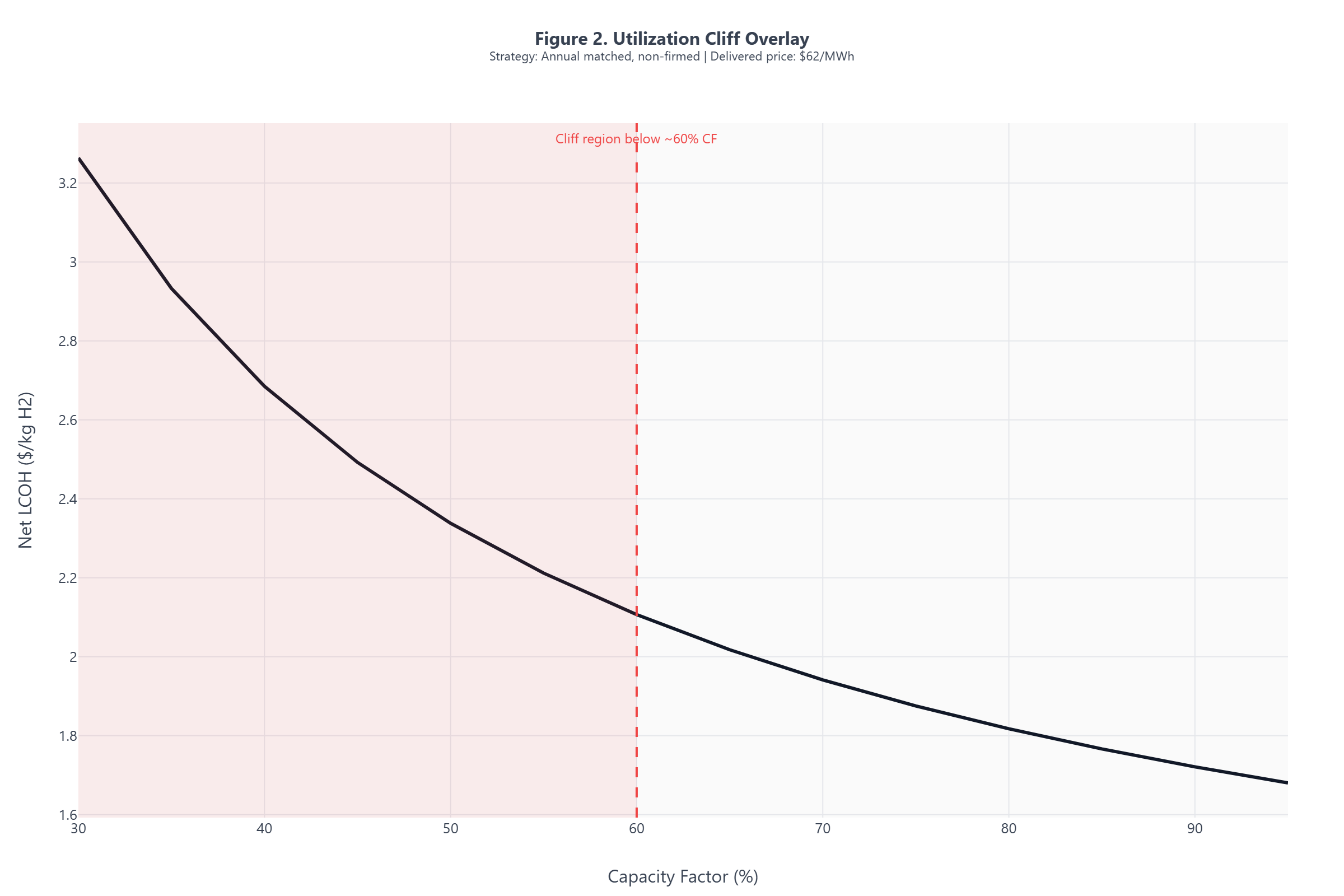

Figure 2 - Utilization Cliff Overlay

Where small CF losses produce large cost jumps

Figure 2: Cost sensitivity to utilization is nonlinear. Below approximately 60 percent CF, small utilization losses produce disproportionate cost jumps that flip the decision from viable to non-viable.

Cost sensitivity to utilization is highly nonlinear below approximately 60 percent CF. Projects operating near this threshold carry asymmetric downside risk: small utilization losses flip the decision from viable to non-viable.

Note: Cliff behavior is amplified when credit-tier boundaries interact with utilization thresholds.

Decision relevance: Avoid sizing or procurement strategies that place expected utilization near the cliff region without substantial margin.

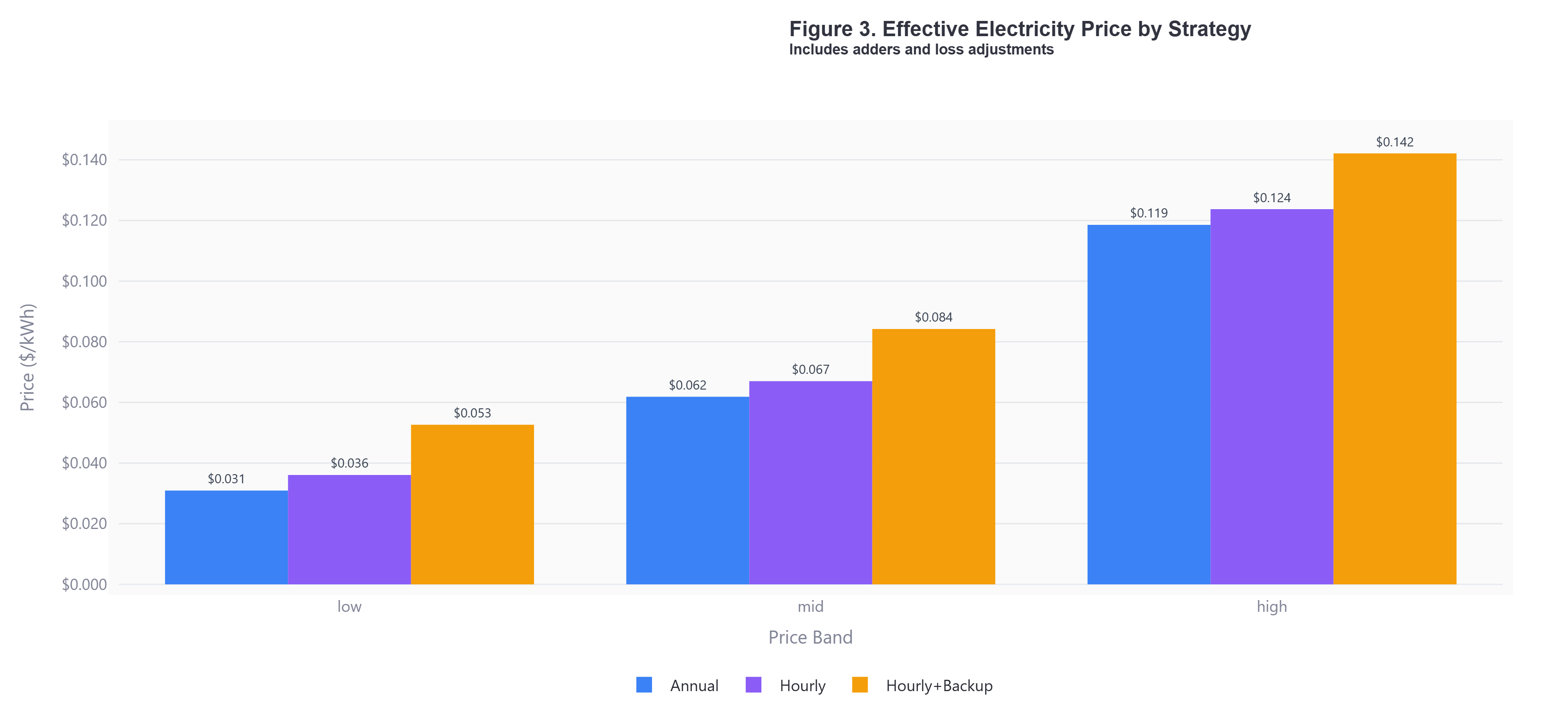

Figure 3 - Effective Electricity Price by Procurement Strategy

Includes adders, losses, and utilization effects

Figure 3: Nominal PPA price is not the decision variable. Once matching, firming, and utilization penalties are included, some higher-priced firm strategies deliver lower hydrogen cost than cheaper intermittent strategies.

Nominal PPA price is not the decision variable. Once utilization effects are included, some "expensive" firm power strategies deliver lower hydrogen cost than "cheap" intermittent strategies with utilization collapse.

Note: Effective price reflects nominal price plus modeled adders and loss penalties, adjusted for utilization impact on capital recovery.

Decision relevance: Evaluate procurement options on effective hydrogen cost, not headline electricity price.

Figure 4 - LCOH vs Capacity Factor

Capital recovery dominance at low utilization

Figure 4: Capital recovery dominates below approximately 50 percent CF. At this utilization, LCOH exceeds grey benchmarks regardless of electricity price, and further price reductions cannot restore parity.

LCOH rises steeply below approximately 50 percent CF as capital recovery dominates the cost stack. A project at approximately 60 percent CF pays a capital penalty that cannot be offset by marginal electricity cost reductions.

Decision relevance: Use this curve to judge how far utilization can fall before parity breaks at each electricity price point.

4. Decision Implications

Siting: Favor locations where utilization can be sustained at or above the viability threshold, not just where cheap power is advertised. Grid stability, curtailment history, and matching feasibility matter more than headline PPA price.

Procurement: Reliability and firming can dominate nominal price reductions. A procurement strategy that sacrifices utilization for low $/MWh may produce higher $/kg H₂.

Design: Electrolyzer sizing should reflect realistic utilization based on procurement structure, not nameplate ambition or best-case availability assumptions.

Risk posture: Projects operating near utilization thresholds carry asymmetric downside risk. Small utilization losses near the cliff produce disproportionate cost impacts; margin is essential.

Utilization should be weighted above electricity price in procurement and siting decisions when any of the following conditions apply:

1. The grid region has a high intermittency index (renewable penetration above 30 percent with limited dispatchable backup).

2. The PPA or procurement structure lacks firming capacity or minimum energy delivery guarantees.

3. The project's base-case CF falls below 60 percent, placing it in the nonlinear cost sensitivity zone.

4. Investors or lenders require downside protection against utilization variance exceeding 10 percentage points from the base case.

5. The applicable matching regime is hourly (post-2028) and the primary electricity source is a single intermittent resource.

If two or more conditions apply, the project should be evaluated on utilization-adjusted LCOH rather than nominal electricity cost. If three or more apply, utilization risk is the dominant feasibility constraint.

What fails diligence screens

The following configurations are non-bankable under conservative assumptions. They do not “struggle” or “face challenges.” They fail.

- Merchant intermittent power without utilization guarantees. Without contracted capacity factor floors, utilization is a weather outcome. Lenders cannot underwrite weather outcomes as base-case economics.

- Hourly matched strategies without firming. Hourly matching compresses CF to the availability profile of the matched generation. Without storage or firming, solar-only configurations fall below 40 percent CF and wind-only below 50 percent in most regions. These do not clear the viability threshold.

- Projects with modeled CF below 50 percent. These projects cannot maintain cost parity with grey hydrogen regardless of nominal electricity price. Capital recovery at this utilization exceeds the margin that any electricity price reduction can offset. They are structurally non-competitive, not marginally so.

Project finance interactions

Utilization risk does not stay inside the cost model. It propagates into financing terms, contract structure, and risk allocation.

Cost of capital. Lenders and equity investors price utilization uncertainty into the weighted average cost of capital. Projects with uncontracted or weather-dependent CF face higher discount rates, which further increase levelized capital recovery and tighten the parity window. A project that models 8 percent WACC but faces 10-12 percent due to utilization risk may lose 15-25 percent of its apparent cost margin before operations begin.

PPA design. Procurement contracts that prioritize low headline price without CF guarantees transfer utilization risk from the power seller to the hydrogen project. Effective PPA structures for hydrogen should include minimum annual energy delivery obligations, curtailment compensation mechanisms, and utilization floor commitments. Without these, the PPA price is not the delivered cost.

Contractual risk mitigants. The following contract features directly address utilization risk:

- Capacity factor floors in offtake or PPA agreements that guarantee minimum operating hours

- Take-or-pay structures with the power supplier that align incentives around delivery, not just availability

- Firming obligations that require the electricity provider to backstop intermittency gaps

- Utilization-indexed pricing in hydrogen offtake agreements that adjust delivery commitments to realized CF

Projects that lack these structural protections carry utilization risk as unhedged exposure. Diligence should verify that contract terms match the utilization assumptions in the cost model.

5. Scope & Boundaries

Boundary statements (scope gate):

- Geography/market: United States; 45V-eligible clean hydrogen markets.

- System boundary: Delivered-to-user gate cost parity (not plant fence, not policy-adjusted averages).

- Time boundary: Commercial year 2026 with 45V policy vintage valid as of February 2026.

- Analytical scope (excluded disciplines): No legal interpretation, certification advice, detailed process engineering/design, permitting, or grid-dispatch modeling.

- Baseline definition: Grey hydrogen comparators defined by low/mid/high delivered cost benchmarks (see Appendix A). Grey low (~$1.00/kg), mid (~$1.50/kg), high (~$2.50/kg).

Key modeling assumptions

| Parameter | Base Assumption | Variation Tested |

|---|---|---|

| Delivered electricity price | $25-$40/MWh (nominal, pre-adders) | Range: $25-$70/MWh |

| Capacity factor | 50-80% (strategy-dependent) | Range: 30-95% |

| Energy storage | Not included in base case | Firmed renewable scenario includes round-trip losses |

| Firming contracts | Modeled as procurement scenario, not endogenous | Firm power scenario assumes contracted CF at higher $/MWh |

| Grid region | Region-agnostic base case | ERCOT, CAISO, PJM illustrative overlays (Section 6.2) |

| Grey hydrogen benchmark | $1.50/kg (mid case) | $1.00/kg (low), $2.50/kg (high) |

| 45V credit | $3.00/kg Tier 1 | Credit haircuts modeled at tier boundaries |

| Discount rate | 8% real | Not varied (project finance baseline) |

Storage and firming are treated as procurement strategy features that affect both delivered electricity cost and realized utilization, not as separate cost line items. See Appendix A for full parameter specifications.

Interpretation guardrails: Forward-looking inputs are scenario assumptions, not predictions. This brief is an economic parity analysis; it is not legal advice, not a project certification, and not a forward price forecast.

6. Limitations & Critiques

-

Utilization modeled as scenario-driven, not dispatch-optimized. The analysis treats capacity factor as an input scenario rather than an endogenously optimized dispatch outcome. Real projects may have more or less utilization flexibility than modeled.

-

No endogenous electricity price feedback. Electricity prices are treated as exogenous inputs. Large-scale hydrogen deployment could affect regional electricity prices, which is not captured.

-

Credit rules applied mechanically, not legally interpreted. 45V eligibility and tier boundaries are modeled based on published Treasury guidance but do not constitute legal interpretation.

-

Grey benchmark uncertainty. Grey hydrogen costs vary by region, time, and natural gas price. The low/mid/high bands are reference cases, not predictions.

Response / Mitigations. Results are intended to bound feasibility and inform early-stage decisions, not replace project-specific diligence. Stress-test utilization assumptions and grey benchmarks for site-specific contexts.

6.1 Stress Scenarios (Beyond Base Case)

The base-case analysis holds several inputs constant that may shift materially in practice. Projects should stress-test parity under the following scenarios:

Grey benchmark volatility - The $1.50/kg mid-case assumes stable natural gas prices around $3-4/MMBtu. At $6/MMBtu (winter spike or sustained tightness), grey hydrogen rises to $2.00-2.50/kg, expanding the clean parity window. At $2/MMBtu (oversupply), grey falls to $1.00-1.20/kg, collapsing it. Forward gas curves and regional basis differentials should inform benchmark stress tests.

REC/EAC pricing risk - Clean energy attribute certificates may trade at premiums that increase effective delivered electricity cost beyond nominal PPA + adders. If hourly-matched RECs command $5-10/MWh premiums in tight markets, effective electricity cost rises accordingly.

Congestion and curtailment - Grid congestion in renewable-heavy regions (ERCOT West, CAISO shoulder hours) can force negative pricing or curtailment. While negative prices reduce nominal cost, curtailment directly reduces utilization, potentially more than offsetting the price benefit.

Interconnection-driven CF risk - Projects dependent on new generation may face interconnection delays, reducing expected utilization in early operating years. A 12-24 month delay in co-located solar/wind COD compresses the economic window for credit capture.

Re-run parity thresholds under: (1) grey benchmark at $1.00 and $2.50/kg, (2) REC adders of $5-10/MWh, (3) utilization reduced 10-15 percentage points from base case. If parity survives all three, the project has structural margin.

6.2 Regional Mapping (Illustrative)

Utilization risk varies materially by ISO/RTO due to differences in renewable penetration, congestion patterns, and matching feasibility:

ERCOT - High solar/wind penetration creates frequent negative pricing windows but also curtailment risk. West Texas projects face transmission constraints that can suppress realized CF despite abundant renewable resource. Hourly matching feasibility is high but utilization may be weather-limited to 40-55% for solar-only configurations.

CAISO - Duck curve dynamics create midday oversupply and evening ramps. Storage-backed firming is increasingly necessary to maintain utilization through evening hours. Projects without firming may see CF compressed to 35-45% under hourly matching despite access to low-cost midday solar.

PJM - Lower renewable penetration means less negative pricing but also less access to cheap clean power. Projects may need to rely on grid power with higher carbon intensity, pushing toward credit-tier boundaries. Firm nuclear-backed configurations may achieve higher CF (70-85%) but at higher delivered electricity cost.

| Region | Typical CF Range (Hourly Matched) | Primary Utilization Risk | Firming Requirement |

|---|---|---|---|

| ERCOT | 40-55% | Curtailment, transmission | Moderate |

| CAISO | 35-45% | Duck curve, evening ramp | High |

| PJM | 50-65% | Limited cheap clean supply | Low-Moderate |

Regional estimates are illustrative and depend on specific project configuration, interconnection point, and procurement structure.

7. Methods & Traceability (Analytical Lens)

This note applies a techno-economic parity lens using representative model runs from the Insight Quantix analysis engine. Key features of the lens:

- Comparison at the user gate (not plant fence, not policy-adjusted averages)

- Explicit modeling of:

- Electrolyzer utilization (capacity factor) as primary driver

- Delivered electricity price including adders and losses

- Capital recovery amplification under reduced operating hours

- 45V credit value under tier proximity

- Grey hydrogen modeled as a delivered cost benchmark, not a theoretical SMR minimum

- Scenario vs sensitivity treatment: Procurement strategy and grey benchmark are discrete scenarios; electricity price and capacity factor are sensitivities within each scenario.

Results reflect parametric sweeps across the stated ranges, filtered to illustrate utilization-driven parity boundaries and cliff behaviors. Results are illustrative of economic boundaries, not exhaustive optimization.

8. Appendix A: Modeling Parameters

Procurement Strategy Configurations

| Strategy | Adders ($/kWh) | Loss Fraction | Utilization Impact | Basis |

|---|---|---|---|---|

| Intermittent, annual matched | $0.005 | 3% | CF reduced by matching constraints | PPA shaping + scheduling |

| Intermittent, hourly matched | $0.010 | 3% | CF further reduced by hourly compliance | Intra-hour balancing |

| Firm power (grid or firmed renewable) | $0.020 | 5% | CF sustained at contracted level | Firming + round-trip losses |

Adders reflect incremental procurement costs beyond nominal PPA price. Loss fractions represent transmission, conversion, and utilization inefficiencies.

Scenario vs Sensitivity Classification

| Input group | Treatment | Notes |

|---|---|---|

| Procurement strategy | Scenario | Discrete regimes (intermittent/firm/hybrid) |

| Electrolyzer type | Scenario | PEM vs alkaline |

| Grey benchmark band | Scenario (reference case) | Low/mid/high delivered cost cases |

| Electricity price | Sensitivity | Continuous sweep within each scenario |

| Capacity factor | Sensitivity | Continuous sweep within each scenario |

Grey Hydrogen Benchmarks (delivered cost)

| Benchmark | Cost ($/kg H₂) | Description |

|---|---|---|

| Low | $1.00 | Low-cost SMR with ~$3.00/MMBtu natural gas, no carbon capture (U.S. Gulf Coast baseline) |

| Mid | $1.50 | U.S. industrial average delivered cost, 2024-2025 |

| High | $2.50 | Merchant delivered, non-captive, or high-natural-gas-price regions |

Sources: DOE Hydrogen Program Records, IEA Global Hydrogen Review. Grey benchmarks are reference cases, not forecasts; treated as scenario variants.

Analysis Engine Configuration

| Parameter | Value |

|---|---|

| Base Credit (Tier 1) | $3.00/kg H₂ |

| Electricity price range | $0.025–$0.070/kWh (nominal, pre-adders) |

| Capacity factor range | 30%–95% |

| Electrolyzer configurations | PEM (55 kWh/kg) and alkaline (50 kWh/kg) |

| Economic framework | ASTM E3200-compliant TEA |

| Discount rate | 8% real (project finance baseline) |

| Project lifetime | 20 years |

All analyses conform to benchmark-anchored validation protocols as described in Insight Quantix TEA-LCA Engine documentation.

8.1 Appendix B: Policy Compliance Mapping

45V Strategy-to-Constraint Matrix

| Procurement Strategy | Additionality | Deliverability | Temporal Matching | CF | Credit Risk |

|---|---|---|---|---|---|

| Co-located solar (new build) | Satisfied | On-site | Hourly: limited to solar hours | 25–40% | Low |

| Co-located wind (new build) | Satisfied | On-site | Hourly: limited to wind availability | 35–50% | Low |

| Solar + wind hybrid (new build) | Satisfied | On-site | Hourly: complementary profiles | 45–60% | Low |

| PPA with hourly RECs | Depends on vintage | Same region | Hourly: REC timestamp must match | 40–55% | Moderate |

| PPA with annual matching | Depends on vintage | Same region | Annual: higher CF achievable | 60–80% | Higher (post-2027 phase-out) |

| Firmed renewable (storage-backed) | Satisfied | Satisfied | Hourly: storage enables load-following | 70–90% | Low |

| Grid power (low-CI region) | Not satisfied | N/A | N/A | 85–95% | High (may fail Tier 1) |

Policy Parameter Sensitivity

Parity thresholds in this analysis assume current 45V rules. Key policy parameters that would shift thresholds if changed:

| Policy Parameter | Current Assumption | If Relaxed | If Tightened |

|---|---|---|---|

| Temporal matching | Hourly (post-2028) | Higher achievable CF, expanded parity band | N/A |

| Additionality window | 36-month lookback | More existing capacity eligible | Narrower eligible supply |

| Deliverability definition | Same region/BA | Cross-regional RECs allowed | Stricter LMP-based test |

| Tier 1 threshold | <0.45 kg CO₂e/kg H₂ | Higher allowed intensity | Narrower pathway |

Policy rules valid as of February 2026. Treasury guidance updates may materially alter thresholds.

9. Citation Readiness & Reproducibility

-

Publication date & version: February 2026 v1.0 - Canonical URL: https://insightquantix.com/insights/45v-utilization-risk/

- Inputs table: Appendix A (benchmarks + author assumptions labeled; scenario vs sensitivity classified)

- Reproducibility note: Parity boundaries are most sensitive to sustained utilization and procurement regime; changes to these inputs will shift decision regions. Conclusions flip primarily with CF assumptions.

- Disclosure: Insight Quantix derived all analytical conclusions independently; references provide context only.

- Policy validity: 45V rule interpretation valid as of February 2026.

10. Consequences

What must be proven

- That the procurement structure delivers sustained capacity factor above 50 percent under the applicable matching regime. Not modeled. Not projected. Demonstrated or contractually guaranteed.

- That utilization assumptions survive stress scenarios: curtailment, interconnection delay, weather variance, and matching-period misalignment.

- That capital recovery arithmetic closes at the realized CF, not the nameplate CF or the developer’s base case.

What should be discounted

- Headline electricity prices that do not account for matching constraints, firming costs, transmission losses, or utilization penalties.

- Parity claims built on annual matching assumptions after the transition to hourly matching.

- LCOH projections that treat capacity factor as a fixed input rather than a distribution with downside tail risk.

What should not be assumed

- That cheap power guarantees cheap hydrogen. It does not. Below 50 percent CF, it cannot.

- That the cost curve is smooth. It is not. There are cliffs near 60 percent CF where small utilization losses produce large cost jumps.

- That intermittent strategies are viable without firming. Under hourly matching, they fail the utilization test in most configurations.

For correspondence regarding the analysis or its assumptions:

Contact: jamie@insightquantix.com

Full methodology documentation, sensitivity parameter sets, and benchmark validation protocols available upon request for academic collaboration or peer review. The analytical method is transferable to other policy-constrained energy systems (clean ammonia, SAF, e-fuels).

How to Cite This Analytical Note

APA Format

Gomez, J. (2026). 45V Utilization Risk: When Cheap Power Breaks Clean Hydrogen Parity (Insight Quantix Analytical Note IQ-AN-H2-2026-02). Retrieved from https://insightquantix.com/insights/45v-utilization-risk/

Chicago Format

Gomez, Jamie. “45V Utilization Risk: When Cheap Power Breaks Clean Hydrogen Parity.” Insight Quantix Analytical Note IQ-AN-H2-2026-02, February 2026. https://insightquantix.com/insights/45v-utilization-risk/.

BibTeX

@techreport{Gomez2026_H2_Utilization,

author = {Gomez, Jamie},

title = {45V Utilization Risk: When Cheap Power Breaks Clean Hydrogen Parity},

institution = {Insight Quantix},

year = {2026},

type = {Analytical Note},

number = {IQ-AN-H2-2026-02},

month = feb,

url = {https://insightquantix.com/insights/45v-utilization-risk/}

}

Changelog

- v1.0 (2026-02-04): Initial release.

About the Author

About Insight Quantix

Insight Quantix publishes independent analytical work for transparency and decision clarity. The analysis examines benchmark-anchored, audit-defensible economic risk conditions relevant to capital allocation decisions in the $10M–$500M range.

Validation Methodology: ASTM E3200 | ISO 14040/14044 | NREL benchmark-anchored Engine Documentation: Available upon request Website: insightquantix.com

Legal Disclaimer

This analytical note is provided for informational and educational purposes only and does not constitute investment advice, financial advice, engineering design recommendations, or legal interpretation of tax policy. Readers should conduct independent due diligence and consult qualified professionals before making capital allocation decisions.

The analysis reflects representative scenarios based on stated modeling parameters and should not be construed as a guarantee of project performance or economic outcomes. Specific project economics require site-specific analysis accounting for local conditions, technology configurations, and regulatory environments.

Insight Quantix makes no warranties, express or implied, regarding the accuracy, completeness, or reliability of this information for any particular purpose.

© 2026 Insight Quantix. This analytical note may be cited with proper attribution.